Do you want to put your money in the futures market? It can be a very lucrative venture, but it is essential to choose prudently when deciding what broker to entrust with your investments. When selecting a futures broker, it’s critical to consider several factors, such as their security measures and platform capabilities.

Such aspects are integral for protecting your fund and potentially maximising returns from trading relegated instruments with the help of advanced technologies. With this article, we will provide insights and recommendations on finding a trusted broker that fits your needs – helping you make an informed decision that could bring great success in future markets.

Understand your needs and goals as an investor

Before embarking on your search for a futures broker, it is of utmost importance to establish clear objectives and requirements as an investor. Take the time to assess your risk tolerance level and determine the amount of capital you are willing to invest in the market. Additionally, consider whether you envision yourself as an active trader, constantly monitoring and managing your positions, or a passive trader, taking a more hands-off approach.

By gaining a comprehensive understanding of your needs and goals, you will be better equipped to evaluate potential brokers based on their specific offerings and services. It includes considering trading platforms, research tools, educational resources, customer support, and fees.

Remember, choosing the right futures broker is a crucial decision that can significantly impact your trading experience and success. Taking the time to evaluate and compare your options thoroughly will ensure that you find a broker that aligns with your unique requirements and maximises your potential for lucrative trading.

Evaluate the broker’s fees, commissions, and margin requirements

Regarding futures trading, fees and commissions can significantly affect your bottom line. As such, it’s essential to carefully review the fee structure of potential brokers before making a final decision. Some brokers may charge lower commissions but make up for it with higher margin requirements or other hidden fees.

In addition to evaluating the standard commission rate per trade, consider any additional fees for inactivity, data feeds, platform usage, and account maintenance. These costs can quickly add up and impact your potential profitability as a trader.

Research the broker’s reputation and customer service record

The safety and security of your investments should be a top priority when selecting a futures broker. It’s essential to thoroughly research the reputation and track record of potential brokers before entrusting them with your funds.

Look for brokers regulated by reputable authorities, such as the Commodity Futures Trading Commission (CFTC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom. These regulatory bodies ensure that brokers are operating within legal and ethical guidelines.

Furthermore, consider the broker’s customer service record. Do they have a history of providing prompt and practical support to their clients? Are there any red flags or negative reviews regarding their services? Choosing a broker with a strong reputation for customer service can give you peace of mind, knowing that your investments are in capable hands.

Determine the broker’s trading tools and platforms

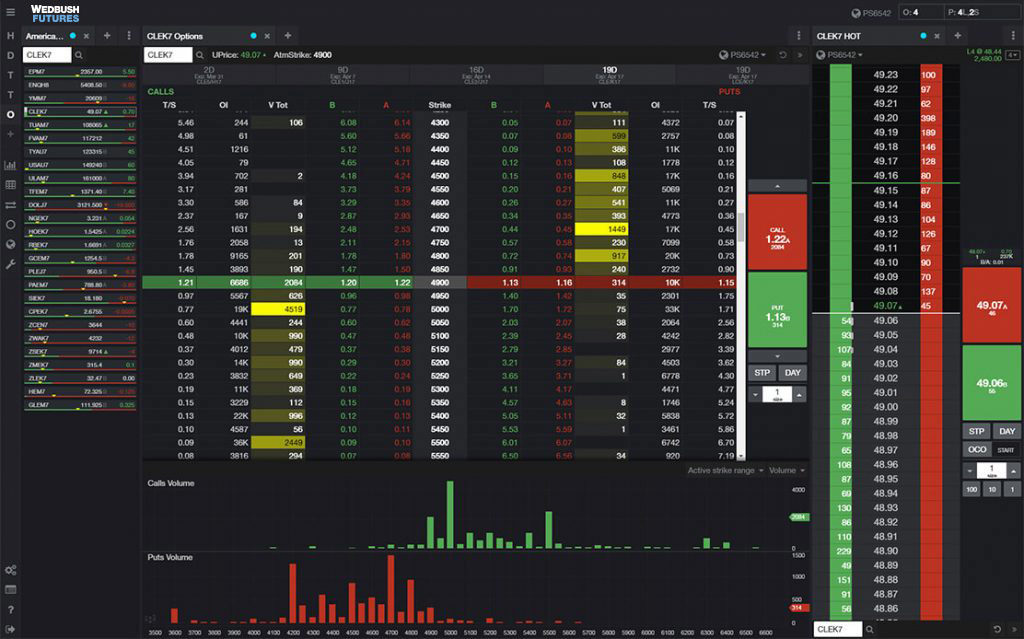

Another crucial aspect to consider when choosing a futures broker is the trading tools and platforms they offer. These can significantly impact your ability to effectively analyse market trends, execute trades, and manage risk.

Look for brokers that provide advanced charting software, real-time data feeds, and customisable order entry options. Additionally, consider whether the broker’s platform is user-friendly and offers features like mobile trading and automated trading strategies.

By choosing a broker with robust trading tools and platforms, you can significantly improve your chances of success in the futures market. These features can help you make informed decisions and execute trades quickly and efficiently.

Check for regulatory compliance with national securities laws

In addition to thoroughly researching a broker’s reputation and regulatory compliance, it is crucial to ensure that they strictly adhere to national securities laws. It encompasses not only following anti-money laundering measures and safeguarding client data privacy but also diligently meeting all other legal requirements.

To verify a broker’s compliance, it is recommended to check their registration status with relevant regulatory bodies. Additionally, it is advisable to review any past disciplinary actions or sanctions that the broker may have received. This level of due diligence will provide an extra layer of protection for your investments, significantly reducing the risk of encountering fraud or engaging in unethical practices. By taking these measures, you can rest assured that your financial interests are safeguarded to the fullest extent possible.

Review the broker’s product portfolio to ensure it meets your needs

Finally, it is crucial to review a broker’s product portfolio in detail to ensure that they offer the instruments and assets you are interested in trading. It includes evaluating their range of futures contracts, options, and other derivative products.

Moreover, consider whether the broker offers access to various global markets, as well as alternative investment opportunities such as commodities or cryptocurrencies. Having a diverse selection of products to choose from can provide you with more flexibility and potential trading opportunities.